At CBHS we’re proudly not-for-profit, like all funds that belong to the Members Health Fund Alliance.

People often ask, do I need health insurance? Is private health insurance worth it? But the question people often forget to ask is, should I belong to a not-for-profit?

Most of us would agree that looking after our health, and the health of our families, matters more than just about anything else in life. That’s why it’s important to choose wisely.

We’ve outlined some of the benefits of belonging to a not-for-profit below.

CBHS is a not-for-profit fund. What does that mean?

Any profit we make – the difference between the income we receive from your premiums and the money we pay out in benefits – gets reinvested to support the provision of services to our members. The people who benefit are you, our members. Members Health funds are all not-for-profit funds.

Why does it matter?

It matters because we’re not driven by the need to make profits for other people. There are no shareholders or foreign investors waiting to take their cut. At CBHS we’re driven by a desire to improve your health. The healthier you are, the happier we are.

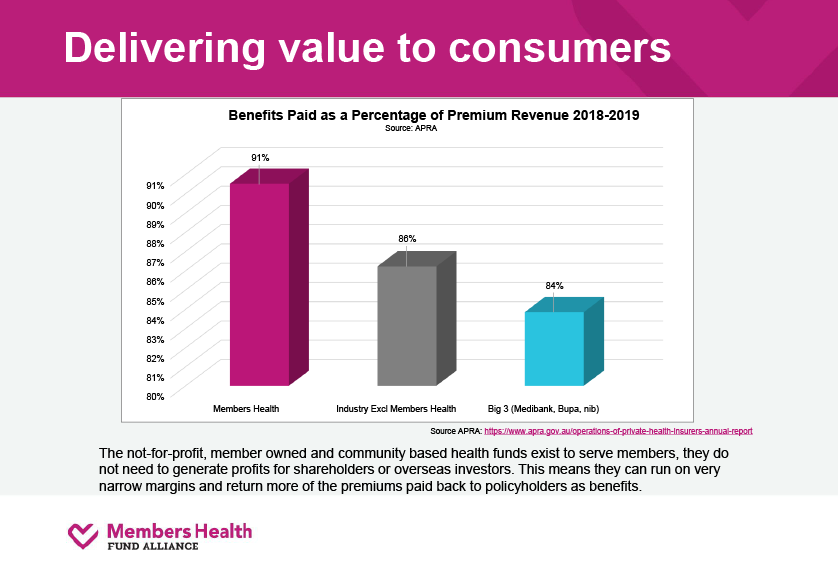

We pay more to members

We consistently pay out more benefits than larger profit-driven funds. The three largest profit-driven funds paid out an average of 84 cents in the dollar in 2018-2019.* Members Health funds paid out an average of 91 cents. We paid out 93 cents.

Our margins are lower

Average margins for Member Health funds was 2.4%.* Compare that with between six and eight percent for three of the big profit-driven funds. Member Health funds operate on very slim margins, so we can afford to give more back to members.

Our members are happier

In the latest survey results, 96% of Members Health fund members said they were satisfied with their health fund membership, and they’re also less likely to want to switch to another fund. Many people are very happy with their health insurance, although you wouldn’t think so to read some of the stories in the media! Don’t let such stories deter you from switching, especially to a not-for-profit fund.

We’re growing faster

Australian consumers are realising the benefits of joining not-for-profit funds, which is why Members Health funds are growing so rapidly. Members Health funds now make up the largest share of the Australian health insurance market.* Combined, they cover over 3 million Australians.

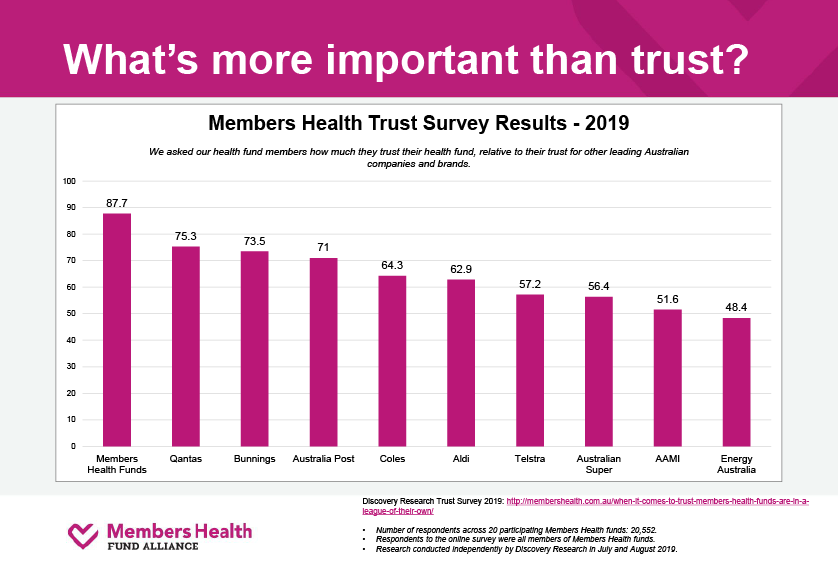

Our members trust us

We work tirelessly on your behalf, running programs and offering services designed to help you stay well and healthy. We want to prevent illness and promote better health, and we do everything we can to keep you out of hospital. We’re not working to profit from your health. We’re working to promote it. Again, research shows that Members Health funds are well respected and highly trusted. Over 87% of members say they trust their not-for-profit health fund.*

We reinvest any surplus

The health and happiness of our members is at the heart of everything we do. Any surplus we make is reinvested back into the fund, to keep strengthening the benefits we can offer our members.

Can you join CBHS?

We’re a restricted fund, which means only certain people can join CBHS. If you or a member of your family has ever worked for the Commonwealth Bank Group – either as a current or former employee or contractor – you may be eligible. Find out now. You can also ask us for a no-obligation quote or call our Member Care team on 1300 654 123.

*Source: Members Health Fund Alliance, ‘Why our funds are different’ (Nov 2019)

https://www.apra.gov.au/operations-of-private-health-insurers-annual-report

www.privatehealth.gov.au

www.membershealth.com.au